14 min read

Looking Into the Future: Therapeutic Antibody Trends

Although Antibody Solutions focuses primarily on therapeutic antibody discovery – the earlier stages of drug development – I have always felt it was important to stay informed on the later stages of the process. That is, keeping an eye on the antibodies that have gained regulatory approval and reached the market. I feel our antibody discovery efforts can be guided by answering two questions: Which sources of antibodies (e.g., mouse, humanized mouse, transgenic mouse, structural libraries) have led to approved antibody therapies; and, which antibody formats (e.g., monospecific, bispecific, antibody drug conjugate (ADC), chimeric) are being used to deliver these therapies? In discovery, there are many options available as to antibody sources and formats. So, which ones are winning?

Last year was a big one for therapeutic antibody approvals. This is immediately apparent with even a cursory glance through The Antibody Society’s “Antibodies to Watch in 2023.” In their year-end snapshot, which appears annually in mAbs, The Antibody Society reports on the past years’ newly approved antibody therapeutics, and others nearing approval. Additionally, their report offers an extensive database of antibody drugs that are in late stage (Phase 2 or Phase 3) clinical trials.

Using “Antibodies to Watch in 2023” as a starting point, we compiled information on the sources and formats for antibody drugs approved in 2022, as well as those approved in the first nine months of 2023; we did the same thing with late-stage antibodies. Following the “Antibodies to Watch in 2023” model, we have segregated the results according to disease areas (broadly, cancer and non-cancer) to see if any sub-trends exist in those areas as to sources and formats that are working. In doing this, we sought to identify common traits shared by successful and promising antibodies, while also examining recent trends in antibody drug discovery and development.

Antibody Drugs Approved in 2022

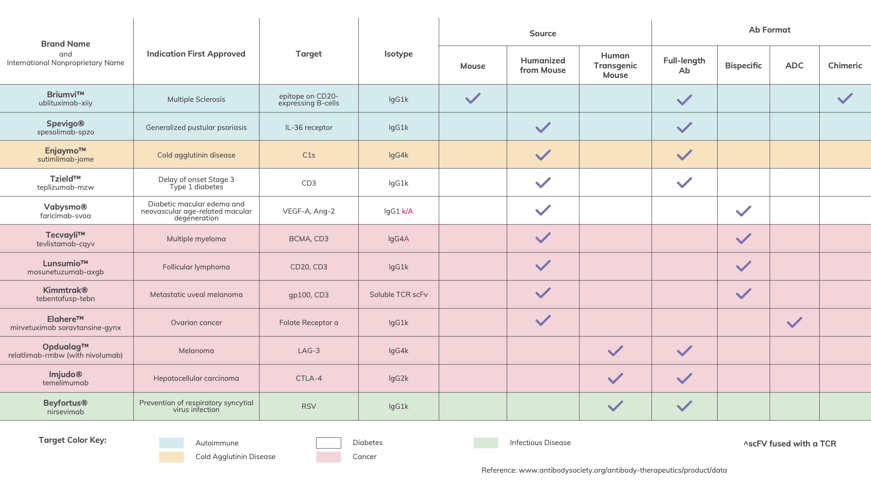

The Food and Drug Administration (FDA) and European Medicines Agency (EMA) both approved 12 antibody drugs in 2022. These drugs and their major characteristics are presented in Figure 1 below. In addition to the name, indication target and Isotype, all information readily available, we included the source and Ab format based upon our research. We should note that we list Lunsumio (mosunetuzumab-axgb) and Briumvi (ublituximab-xiiy) as approved because both were approved before the end of 2022 but after the publication of “Antibodies to Watch in 2023.” Additionally, we’ve left out Evusheld (tixagevimab and cilgavimab) as the FDA withdrew its emergency-use authorization in January, 2023.

Figure 1: US and EU Approvals of Novel Antibody Therapies in 2022

Antibody drugs approved by the FDA and EMA in 2022. They are presented here with their applications, indicated by color, and their modalities, indicated by checkmark. (Please Note: Information provided here is based on our own best research and cross-referencing. We welcome you to contact us regarding any corrections or omissions.)

As we look at the data for 2022’s approved antibody drugs, we can spot a number of interesting trends. First, with regards to format: seven of the drugs on this list are full length antibodies; three are antibody bispecifics; one is an scFV-TCR bispecific; and one is an antibody drug conjugate (ADC). Kappa light chains dominate across all indications, which are split evenly between cancer and non-cancer. Slightly more than half (seven out of 12) of these drugs are IgG1. Cancer drugs Opdualag™ (nivolumab and relatlimab) and Tecvayli (teclistamab-cqyv), plus the autoimmune-targeted drug Enjaymo® (sutimlimab-jome), are IgG4. The wildcards in the group are the cancer-targeting Imjudo® (tremelimumab), which is IgG2, and Kimmtrak™ (tebentafusp-tebn), an scFv-TCR bispecific construct.

What really stands out to me, however, are the sources for each antibody drug. We found that one therapeutic was derived from a fully mouse antibody, eight from mouse antibodies with humanized sequences, and three from transgenic mice producing human VH and VL sequences. Ultimately, all of the antibody drugs that received FDA approval in 2022 were animal-derived, with none coming from naive human Ig phage display platforms or other human structural libraries.

Antibodies in Late-Stage Clinical Trials

As part of their work monitoring the global antibody market, The Antibody Society keeps tabs on hundreds of emerging constructs.

At the time “Antibodies to Watch in 2023” was published, the organization had nearly 1,200 Ab therapeutics currently in clinical studies on its radar. In the supplemental material for this article, The Antibody Society provides a generously detailed cache of data for 138 of these therapeutic antibody candidates. As of November, 2022, these antibody drug candidates were in late-stage clinical studies (i.e., pivotal Phase 2, Phase 2/3 or Phase 3). The Antibody Society keeps an evolving list of significant Phase 2 and Phase 3 antibodies, which they update quarterly. While they account for only about 12% of all antibody drugs in development throughout the world, we felt that they could reveal insights about important emerging and ongoing trends.

To interrogate this data, we took The Antibody Society’s list – which was divided by cancer and non-cancer indicators – and broke it down further by antibody source and format based upon this list and our own supplementary research. (Whenever possible, we verified The Antibody Society's data on each antibody’s source and format via an official secondary source.)

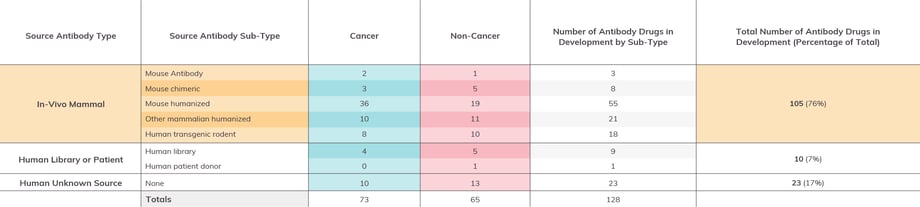

Figure 2: Antibodies in Late-Stage Drug Development by Source

Antibody drugs in Phase 2 and/or Phase 3 by the end of 2022, with data sets separated into columns denoting cancer and non-cancer indicators. (Please Note: Information given is based on our own best research and cross-referencing. We encourage readers to contact us regarding any corrections or omissions.)

Of the 115 late stage antibodies with identifiable sources, 105 are derived from in-vivo animal based sources (i.e., wildtype mouse or rat, human transgenic rodent), and 10 are derived from a human patient donor or library source. An additional 23 are human antibodies, though we were unable to identify their specific sources. For immuno-oncology targeted drugs, there was a bias towards mouse -humanized antibodies as the source. Otherwise, similar sources were used for both immuno-oncology and other targeted drugs.

“Antibodies to Watch in 2023” makes a point of highlighting the appearance of “non canonical full-length molecules,” devoting quite a bit of attention to bispecifics and ADCs. These are two relatively new classes of antibody drug format, but they’ve been making significant impacts on the antibody drug landscape. We’ve seen a number of companies explore these modalities in recent years, and even aideding a few in their explorations. (See our previous Insights post for an at-length discussion of ADCs.)

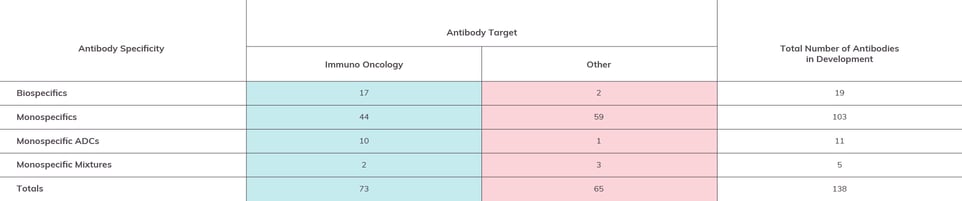

The current crop of Phase 2 and Phase 3 drugs, much like the approved 2022 drugs we covered above, indicate steady (if sometimes slow) rates of success with these non-traditional models. In Figure 3 (below), we re-sorted the antibodies in The Antibody Society’s supplemental material by specificity (monospecific, bispecific, monospecific mixture, or ADC), then looked at how many molecules in each category were aimed at cancer versus non-cancer targets.

Figure 3: Antibodies in Late-Stage Drug Development by Format

Antibodies in Phase 2 and/or Phase 3 by the end of 2022 by specificity. As with Figure 2, data sets are separated by immuno-oncology targeted constructs and other targets. (Please Note: Information given is based on our own best research and cross-referencing. We encourage readers to contact us regarding any corrections or omissions.)

While monospecific antibody constructs make up the majority (nearly 75%) of the antibodies on this list, we do see 19 bispecifics and 11 ADCs, as well as five “monospecific mixtures” (drug candidates that combine two or even three monospecific antibodies).

Most bispecifics are cancer-targeted. The two bispecifics that aren’t cancer-targeted, NNC0365-3769 and gefurulimab, are for treatment of hemophilia A and myasthenia gravis, respectively. It remains to be seen whether bispecifics will be targeted to a broader range of non-cancer targets.

Most ADCs are also cancer-targeted. One that stands out, by virtue of also being the only non-cancer-specific ADC, is a mixture of murine antibodies dafsolimab setaritox and grisnilimab setaritox being developed by Xenikos to targets steroid-refractory acute graft vs. host disease. It will be interesting to see if more “armed” antibodies that are not directed to immuno-oncology targets emerge in the future.

Antibody Drug Approvals Since the New Year

As of August, 2023, eight new drugs received FDA regulatory approval. In the order they were announced, the approved drugs are Leqembi™ (lecanemab-irmb), Zynyz™ (retifanlimab-dlwr), Epkinly™ (epcoritamab-bysp), Columvi® (glofitamab-gxbm), Rystiggo® (rozanolixizumab-noli), Talvey™ (talquetamab-tgvs), Elrexfio™ (elranatamab-bcmm) and Veopoz™ (pozelimab-bbfg). Epkinly, Columvi and Talvey are notable for their bispecific format and Rystiggo is a humanized chimeric antibody. The source for all of these approved drugs are humanized mouse antibodies, with the exception of Veopoz, which is derived from a transgenic mouse. This further validates in-vivo sources as being the most reliable for antibody therapeutic discovery. If 2023 approvals continue at this rate, we’re also likely to see a similar number of antibodies approved as were in 2022.

Long-Term Trends

If we look at the antibody drug approval from 2022 and the first eight months of 2023, as well as the Phase 2 and Phase 3 data, we find that the most reliable source of therapeutic antibodies has consistently been animal immunization. But how do these findings fit in with industry trends overall? Our findings from The Antibody Society’s data for the last year and a half would appear to be a continuation of broader industry trends.

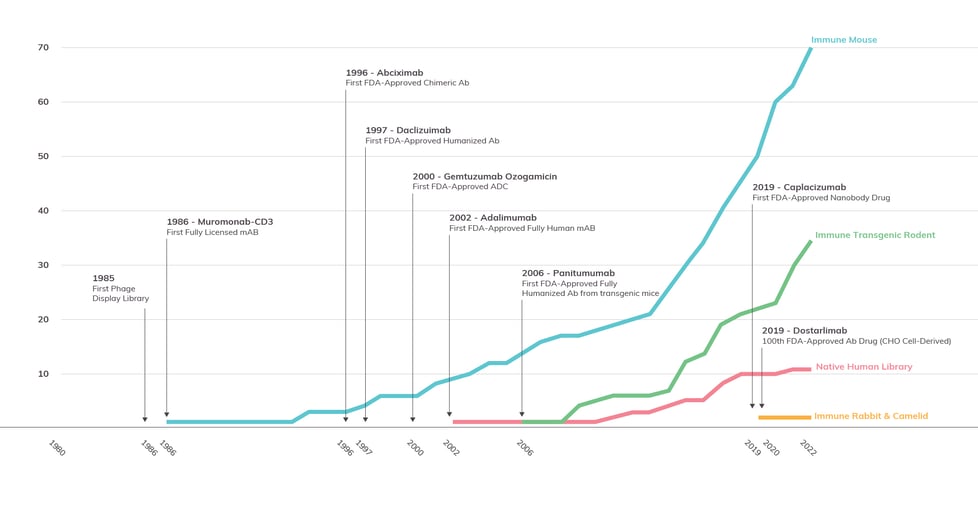

Antibody Solutions has been monitoring and comparing the successes of animal and library models for years. In the graph below, Figure 4, you can see the rate-per-year of approval for four classes of therapeutic antibodies by source: immune mouse, immune transgenic rodent, naïve human library, and immune rabbit and camelid. To provide additional context, we’ve included some major technological breakthroughs that occurred during this timeline.

Figure 4: FDA Approvals of Therapeutic Antibodies by Source

This figure, adapted from the graph provided in a previous Insights post, shows the 1986-2022 cumulative growth of antibody therapeutics that were derived from four major sources: immune mice, immune transgenic rodents, naive human libraries, and immune rabbit and camelid antibodies. Compiled by Antibody Solutions from data provided by Lu et al., Alfaleh et al., and The Antibody Society.

Since the approval of the first therapeutic antibody more than 40 years ago, we have seen in-vivo models significantly outperform other technologies. More than 90% of the antibodies approved by the FDA for therapeutic use have been derived from immune mouse antibodies. Conventional animals, historically, have the highest rate of success. Consequently, they are the most popular method for antibody generation; this has been aided greatly by improvements in humanization. The second leading group, the immune human antibody-producing transgenic rodent (i.e., mouse and rat), has grown at a similar rate of approval as the immune mouse despite getting a much later start. In some instances, its rate of approvals has even exceeded that of immune rodents.

Native human library-derived antibodies have not kept pace with either immune conventional mouse or transgenic rodent sources, despite a longer development history. This could be due, at least in part, to biophysical properties of antibodies derived from mammalian sources having fewer red flags (unfavorable biophysical properties) than antibodies from synthetic platforms. This data speaks to the value gained from harnessing the natural immune response of animals to immunization.

While not reflected in 2022 approvals data set, I expect in the coming years that we will see growth in approvals for fully-human antibodies sourced from human antibody-producing transgenic animals. At the discovery level, transgenic animals (including mouse, rat, and chicken) have become more widely available. They have some unique advantages over conventional animals. Their antibodies are likely to be less immunogenic in humans, and their time to market would likely be shorter since humanization doesn’t need to be performed. There are several transgenic animal engineering projects currently being undertaken, by multiple groups, to increase the diversity of antibodies produced by the animals. These efforts include having different and multiple MHC class 2 backgrounds, hyperimmune characteristics, utilization of kappa and/or lambda light chains, as well as fixed light antibodies and heavy chain only antibodies that enable creation of bi-specific antibodies.

I’ve written before about the enduring value of animal-based research, challenging recent claims by The European Union Reference Laboratory that synthetic display technologies have evolved to such an extent “that animals should no longer be used for the development and production of antibodies.” There is no denying that synthetic libraries – which have existed for more than 30 years and have many academic and commercial practitioners – do offer valuable discovery avenues. We absolutely agree that in vitro alternatives can be used effectively in some instances, and should be used when scientifically merited. Like any responsible CRO, we look for ways to reduce or eliminate animal usage when conducting discovery projects, adhering whenever possible to the “three Rs” approach of replacement, reduction, and refinement. Animal-based technology, however, is still an essential component in the pursuit of novel antibody therapies.

At Antibody Solutions, we are always working to provide services that will set our customers’ projects on the path towards success. Most drugs take a decade or more to go from initial discovery phase to FDA approval, so you can never be sure which models, approaches to discovery, and other tools will guarantee long-term success. You can, however, see how the work your organization is doing compares with both long-term and recent industry successes. Another enduring trend that you can count on is our commitment to quality products and services. If you’ve got an antibody project or two in the works but aren’t sure how to proceed, consider dropping us a line to learn more about how our Cellestive™ antibody discovery services platform can be put to work creating your next antibody to watch.

Author of more than 40 publications, John’s current research interests include new technologies for improving therapeutic antibody discovery, properties of next-generation antibody-like molecules, and best practices for critical reagents used in biologics development.